This is the time of year businesses start exploring the advantages of section 179 of the tax code and Bonus Depreciation. The interest gets more intense as the year comes to an end. It is best to start year end planning NOW to make year end deliveries on machine tools.

David Goose of Commercial Credit Group understands this process better than most and has provided Fox Machinery’s customers with guidance for the past 12 years. As a part of his whitepaper entitled “The New Tax Law & Its Impact On Equipment Financing,” Goose reviews the new tax laws, laying out:

• Section 179 and Bonus Depreciation

• Corporations and Pass-through Entities

• Tax Deductible Business Expenses

• NOL, AMT and LKE

You are encouraged to DOWNLOAD and read the full whitepaper, however; we want to touch on one aspect in detail – Section 179.

What is Section 179?

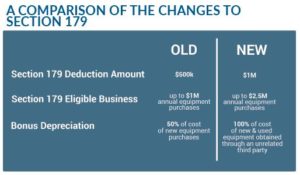

Section 179 allows eligible small to mid-sized businesses to take additional tax deductions and depreciation, based on the purchase of qualifying equipment. These deductions effectively reduce the amount of a company’s taxable income, thus reducing the overall tax burden. There are restrictions and limitations, so if your company is thinking about taking advantage of Section 179 there are some important considerations you should be aware of as you engage in year-end planning.

A Compelling Benefit

Because this write-off can have such a significant impact on a company’s taxes, lets review how Section 179 works and how it can benefit your company. Let’s say your business has a taxable income of $250,000, and purchases a qualifying $250,000 machine. The purchase could effectively bring your taxable income to zero. If you’re in a normal or minimal tax environment this can mean an actual cash savings of around $50,000 or more.

Scheduled to expire in 2023, the change in Section 179 has already had economic impact. With the end goal to grow the US job market, taxpayers are encouraged to spend on equipment useful for manufacturing and building businesses. According to the Equipment Leasing & Finance Association, investments in equipment/software are expected to double in 2018, landing somewhere around 9%. Reports predict a 2.7% economic growth rate this year – powered by the financing and leasing of machinery and equipment.

Scheduled to expire in 2023, the change in Section 179 has already had economic impact. With the end goal to grow the US job market, taxpayers are encouraged to spend on equipment useful for manufacturing and building businesses. According to the Equipment Leasing & Finance Association, investments in equipment/software are expected to double in 2018, landing somewhere around 9%. Reports predict a 2.7% economic growth rate this year – powered by the financing and leasing of machinery and equipment.

The new tax plan contains several provisions that will impact equipment procurement – lower tax rates for businesses, non-deductibility of interest expense for C corporations, limiting like-kind exchanges to real property, and expensing of depreciable assets instead of writing them off over years. The key is to know how these changes may impact a company’s balance sheet, financial plan, and tax strategy, and to adjust accordingly to help improve the company’s financial performance.

Consider having discussions with your accountant, operations team and Fox Sales Engineer before the third quarter. A clear understanding of what technology and machine functionality will have the greatest impact will keep your business in line with your competition.

Want to know more?

CLICK to read a free whitepaper published by the pros: “Tax Cuts and Jobs Act” – an interview conducted by Mark Lempko and Don Pokorny, both of Commercial Credit Group Inc. (CCG), with Dixon Hughes Goodman LLP (DHG).

The information conveyed herein is meant to be informative and should not be construed as specific tax advice.

[maxbutton id=”9″]